TRX Price Prediction: Technical Support Meets Market Volatility

#TRX

- TRX trades below key moving averages but shows bullish MACD momentum suggesting potential reversal

- Justin Sun's significant investments and TRON treasury expansion provide fundamental support amid market controversies

- Bollinger Band positioning indicates current price near support levels with clear resistance targets ahead

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Amid Current Market Conditions

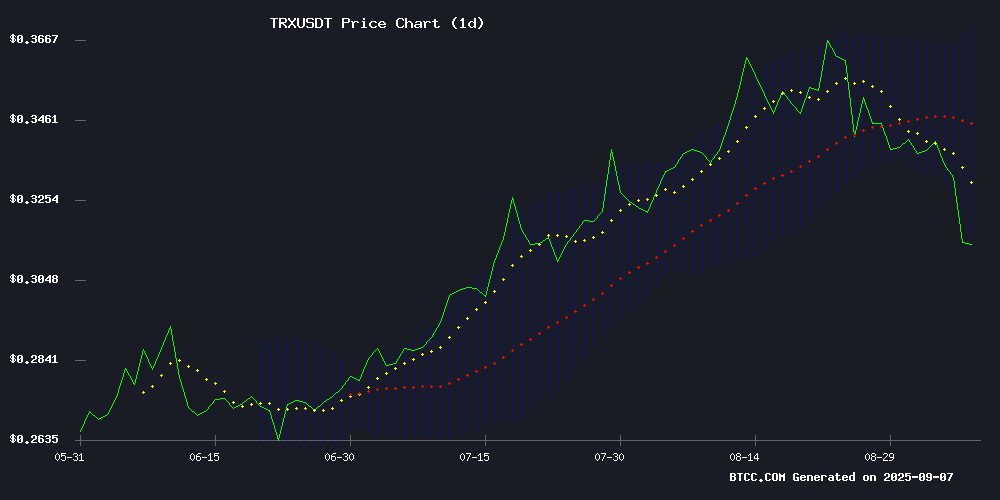

TRX is currently trading at $0.3141, below its 20-day moving average of $0.342955, indicating potential short-term bearish pressure. The MACD indicator shows a positive reading of 0.017125 with a signal line at 0.007917, suggesting some bullish momentum remains intact. The Bollinger Bands position the price NEAR the lower band at $0.316157, which could act as support. According to BTCC financial analyst Robert, 'The technical picture suggests TRX is testing key support levels while maintaining some underlying bullish momentum in the MACD. A break above the middle Bollinger Band at $0.342955 could signal renewed upward movement.'

Market Sentiment: Justin Sun's Moves Create Mixed Signals for TRX

Recent news surrounding TRON and Justin Sun presents a complex sentiment picture. While Sun's $20M commitment to Trump-linked tokens shows continued investment activity, the WLFI token controversy involving wallet blacklisting has created uncertainty. The expansion of TRON's treasury by $665.5M indicates strong institutional backing, but the meme coin frenzy and AI presale momentum may divert attention from established tokens like TRX. BTCC financial analyst Robert notes, 'The news flow creates both opportunities and concerns - while treasury expansion is fundamentally positive, the surrounding controversies and competitive pressures from new tokens could create near-term volatility for TRX.'

Factors Influencing TRX's Price

6 Top New Meme Coins to Watch in 2025: Arctic Pablo Coin Leads the Pack

The meme coin phenomenon continues to captivate crypto investors, with new projects emerging as potential market disruptors. Arctic Pablo Coin (APC) stands out as the current frontrunner, blending mythological storytelling with a 300% bonus incentive and confirmed listing on Coinstore. Its presale activity suggests strong whale interest, positioning it as a potential breakout candidate.

Established players like Dogecoin (DOGE) and Pepe Coin (PEPE) maintain relevance, having demonstrated meme coins' capacity for generating exponential returns. The market appears poised for another cycle of community-driven assets achieving improbable valuations, though selectivity remains crucial amid the hype.

World Liberty Financial Token Plummets 40% Amid Wallet Blacklisting Controversy

World Liberty Financial's WLFI token has cratered 40% since listing, now trading at $0.18, following the project's controversial decision to blacklist 272 wallets. The Trump family-backed blockchain project claims the move targeted phishing attacks, but the inclusion of Tron founder Justin Sun's wallet has raised eyebrows across crypto markets.

On-chain analysis reveals Sun's $9.2 million transfer occurred after the price collapse, contradicting initial speculation about insider dumping. Market makers point to coordinated shorting across exchanges as the primary driver of WLFI's downward spiral, with liquidity evaporating after the blacklist announcement.

The freeze has triggered institutional concerns about centralized intervention in decentralized finance. "When projects start freezing wallets arbitrarily, it defeats the whole purpose of blockchain," said a hedge fund manager holding WLFI positions across three major exchanges.

Justin Sun Commits $20M to Trump-Linked Tokens After Wallet Dispute

Tron founder Justin Sun has pledged to invest $20 million in two Trump-affiliated cryptocurrencies following a contentious wallet blockade by World Liberty Financial (WLFI). The move comes after WLFI froze Sun's wallet when he transferred $9 million worth of tokens to HTX exchange, an action Sun claims was merely a deposit test.

The conflict highlights rare friction in decentralized finance circles, where wallet freezes remain uncommon. Sun's subsequent commitment to buy $10 million each of ALTS and WLFI tokens appears designed to demonstrate confidence in the projects despite the dispute.

WLFI's recent token launch temporarily boosted Donald Trump's reported net worth by $4.1 billion, though questions linger about potential insider sales. The project's decision to block a major investor's transactions has raised eyebrows across crypto markets.

Justin Sun's WLFI Blacklisting Sparks Controversy as DeepSnitch AI Presale Gains Traction

Tron founder Justin Sun faces renewed scrutiny after World Liberty Financial's governance token (WLFI) blacklisted his address following a $9 million transfer to HTX exchange. On-chain data reveals 50 million WLFI tokens were moved during the project's volatile debut week, fueling accusations of price manipulation.

Sun maintains the transaction involved routine deposit tests, but the incident has cast doubt on WLFI's launch integrity. Meanwhile, DeepSnitch AI's presale surges past $182k, capitalizing on market appetite for AI-powered trading tools amid the controversy.

$665.5M Crypto Investment Surge: TRON Expands Treasury, Ethereum Startups Shine

The crypto sector witnessed $665.5 million in disclosed investments between September 1-6, 2025, with TRON's treasury expansion and a $350M merger between AlloyX and Solowin Holdings dominating capital flows. Ethereum-based projects secured notable funding, including $40 million for Etherealize—a Vitalik Buterin-backed initiative bridging DeFi and traditional finance.

Venture rounds outpaced other deal types, with 15 projects securing institutional backing. Utila's $22 million Series A extension highlighted demand for custody solutions, drawing participation from DCG and Funfair Ventures. The capital influx signals growing confidence in blockchain infrastructure despite macroeconomic headwinds.

DeepSnitch AI Presale Gains Momentum Amid WLFI Centralization Concerns

World Liberty Financial's controversial decision to blacklist a wallet linked to TRON founder Justin Sun has reignited debates about centralized control in crypto. The frozen assets, valued at $107 million, followed large outbound transfers that SUN claims were non-market transactions. WLFI's token price plummeted 49% this week as trading volume collapsed by 43%.

DeepSnitch AI emerges as a beneficiary of the fallout, raising $182k in its presale at $0.01634 per token. The project's AI-driven scam detection and trading analytics position it as a decentralized alternative. Market volatility continues driving demand for presale opportunities, with investors seeking insulation from exchange-related risks.

WLFI Defends Wallet Freeze Amid Justin Sun's Token Transfer Controversy

World Liberty Financial (WLFI) has frozen 272 wallets, including one linked to TRON founder Justin Sun, citing phishing protection as the primary motive. The project insists the action targets compromised accounts, not legitimate trading activity.

On-chain analysis reveals Sun's 50 million WLFI transfer occurred hours after the token's steepest decline, contradicting theories of his involvement in the price drop. A separate $12 million transfer from HTX to Binance by a third-party market maker used exchange capital, suggesting routine operations rather than market manipulation.

The incident raises questions about protocol-level intervention powers, with industry observers noting the precedent set by freezing a prominent investor's assets. Market data shows WLFI's volatility persisted despite these protective measures, highlighting the complex balance between security and decentralization in DeFi ecosystems.

Justin Sun's WLFI Tokens Frozen Amid Controversy Over Presale Investment

Tron founder Justin Sun has publicly criticized the World Liberty Financial (WLFI) team after they blacklisted his wallet containing millions of WLFI tokens. Sun, an early backer of the project, invested $45 million in its presale and served in an advisory role. Despite his commitment, his unlocked tokens were frozen—a move he calls "unreasonable" and contrary to blockchain principles of fairness and transparency.

On-chain data reveals Sun purchased 3 billion WLFI tokens at $0.015 each during the presale, with 600 million unlocked at launch. Though he pledged not to sell, transfers of 55 million WLFI to other wallets prompted the WLFI team to freeze his holdings, citing community protection. The decision has ignited debate across crypto circles.

Nansen CEO Alex Svanevik intervened, dispelling speculation that Sun’s transactions caused WLFI’s price drop. The analytics firm’s AI research agent found no evidence of dumping, adding a layer of complexity to the dispute.

How High Will TRX Price Go?

Based on current technical indicators and market sentiment, TRX faces both opportunities and challenges. The price currently trades at $0.3141, with key resistance at the 20-day MA of $0.342955 and the middle Bollinger Band. A breakthrough above these levels could target the upper Bollinger Band at $0.369753.

| Price Level | Significance | Potential Target |

|---|---|---|

| $0.316157 | Lower Bollinger Band (Support) | Immediate support |

| $0.342955 | 20-day MA & Middle Bollinger | Key resistance |

| $0.369753 | Upper Bollinger Band | Near-term target |

BTCC financial analyst Robert suggests, 'The combination of technical support levels and Justin Sun's active market participation provides a foundation for potential growth, though investors should monitor the resolution of current controversies for clearer direction.'